bir zonal value classification code meaning|How to check the Zonal Value of a Property in the : iloilo Zonal Valuation – is an approved zonal schedule of fair market values on real property used by the Bureau of Internal Revenue as basis for the computation of internal revenue taxes.

Synopsis Moms Teach Sex shows mothers catching naughty stepsons and daughters in the act. Instead of getting upset, mom gets horny and joins in the fun to show these young teen couples how it’s .

bir zonal value classification code meaning,It also contains copy of the Tax Code, BIR Forms, Zonal Values of real properties, and other tax information materials.It also contains copy of the Tax Code, BIR Forms, Zonal Values of real properties, .

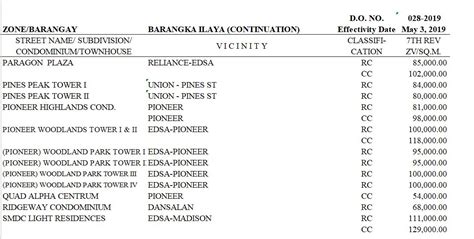

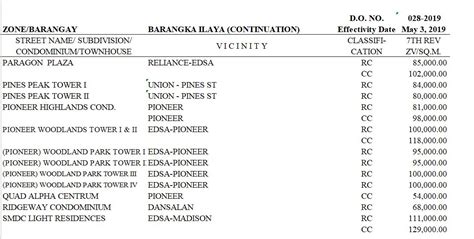

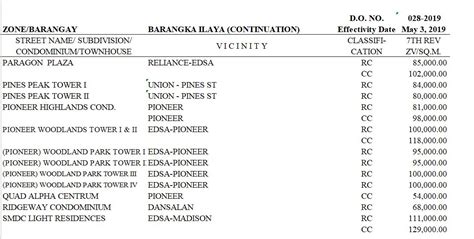

Schedule of Zonal Values of Real Properties within the Jurisdiction of Revenue District Offices and for other purposes in Relation to Sec. 6E of R.A. 10963 otherwise known as .It also contains copy of the Tax Code, BIR Forms, Zonal Values of real properties, and other tax information materials.BIR zonal values refer to the minimum values set by the Bureau of Internal Revenue for different areas or zones within a city or municipality. These values represent the .

Zonal Valuation – is an approved zonal schedule of fair market values on real property used by the Bureau of Internal Revenue as basis for the computation of internal revenue taxes.

Simply put, If you’ve found a property with a selling price that is below the BIR zonal value for that property’s location, it does not follow that the property is a bargain. .

Zonal value refers to the assigned value on real estate properties intended for taxation purposes. This assignment is a principal function of the Bureau of Internal Revenue (BIR) in the Philippines, .

Zonal value refers to the assigned value on real estate properties intended for taxation purposes. This assignment is a principal function of the Bureau of Internal Revenue (BIR) in the Philippines, .

subject: implementation of the revised schedules of zonal values OF REAL PROPERTIES IN THE CITIES OF BIÑAN, CABUYAO, SAN PEDRO, STA.How to check the Zonal Value of a Property in the As many customers are interested in finding out the zonal value of their property, we hereby provide a step by step guide to access the zonal values as published by the BIR. Access for the average, not .Zonal value is the value placed on real estate properties for taxation purposes and it is the basis of our Bureau of Internal Revenue (BIR). The BIR commissioner possesses the .

zonal valuation. 3. zonal values of condominium unit/townhouse: if the title of a particular condominium unit/townhouse is - a.) a condominium certificate of title (cct), the zonal value of the land and the improvements shall be treated as one; or b.) a transfer certificate of title (tct), the land and improvement shall be given

Later on, you noticed that the selling price is less than its zonal value. Without knowing how to compute the zonal value, you thought that the land was being sold for less than its original and actual worth. This is a .

The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .bir zonal value classification code meaning The term Zonal value refers to the property value placed on real estate properties for taxation purposes, which is the basis for our Bureau of Internal Revenue (BIR). Republic Act No. 8424's Section 6 (E) or the Tax Reform Act of 1997 gives the BIR commissioner the power to fix the zonal value schedule.

The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR . (The BIR zonal value page has been updated in 2024 - some of the images might be different but the process stays the same) . Now you have access to the zonal value using a street name and the right classification as appropriate. This guide is made on PC with windows 11, so some screens might look different on a mobile device. .Based on the fair market value, they would determine the assessment level based on the classification of the real property – e.g. residential, industrial, commercial, agricultural, etc. This is what is called “assessed value” that is normally lower than the zonal value of the Bureau of Internal Revenue.

The zonal values established herein shall apply provided the same is higher than (1) the fair . VICINITY MEANS AN AREA, LOCALITY, NEIGHBORHOOD OR DISTRICT ABOUT, NEAR, ADJACENT PROXIMATE OR CONTIGUOUS TO A . CLASSIFICATION LEGEND: CODE CLASSIFICATION CODE CLASSIFICATION RR Residential Regular GL .

Find the zonal value from BIR for any location in Cebu: Cebu City, Badian, Alegria, Compostela, Lapu-Lapu City, Danao City, Sibonga, Tabogon, and more.Estate and donor’s tax 2 Higher of zonal and assessed value Real property tax 1 Assessed value Note: 1. Zonal value is the real property value determined by the BIR. 2. Assessed value refers to the market value determined by the LGUs multiplied to the assessment levels based on the property classifications in the Local Government Code. 10Valuation Standards and a single valuation base for taxation; Pursue property taxation reforms; and Lay the foundation through education and training for the future expansion of property valuation and appraisal activities”;

bir zonal value classification code meaning How to check the Zonal Value of a Property in the The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .Zonal value is the value placed on real estate properties for taxation purposes and it is the basis of our Bureau of Internal Revenue (BIR). The BIR commissioner possesses the authority fix the zonal value schedule under Section 6 (E) of Republic Act No. 8424 or the Tax Reform Act of 1997. The section specifically states that – “SECTION 6.NATIONAL INTERNAL REVENUE CODE OF 1997 As amended by Republic Act (RA) No. 10963 (TRAIN), RA 11256, RA 11346, RA 11467 and RA 11534 (CREATE) TITLE I. ORGANIZATION AND FUNCTION OF THE BUREAU OF INTERNAL REVENUE (As Last Amended by RA 10963) SEC. 1. Title of the Code. - This Code shall be known as the .In a Decision dated February 18, 2014, the trial court declared that the subject property was classified as residential by the Bureau of Internal Revenue (BIR) with a zonal valuation of ₱2,750.00 per sq m. . but the owner's loss. The word "just" is used to intensify the meaning of the word "compensation" and to convey thereby the idea that .

Revenue has determined the zonal values This Order is therefore issued to implement the revised schedules of zonal values of real properties for purposes of computation of any internal revenue tax due on sale/transfer or any other disposition This Order shall take effect BENJAMIN E. DIOKNO Secretary of Finance RECOMMENDED BY:

Latest Update from BIR: 2022. Check the zonal value by typing in the search bar below or filtering by city and classification. Other locations: Zonal Value Philippines

bir zonal value classification code meaning|How to check the Zonal Value of a Property in the

PH0 · Zonal Values

PH1 · Zonal Value in the Philippines: How to Find?

PH2 · Zonal Value in the Philippines: How to Find?

PH3 · Zonal Valuation Information – Philippine Association of Realty

PH4 · Understanding BIR Zonal Values

PH5 · Republic of the Philippines DEPARTMENT OF FINANCE

PH6 · REVENUE MEMORANDUM ORDER NO. 31

PH7 · How to get the zonal value of your property: a step by

PH8 · How to check the Zonal Value of a Property in the

PH9 · Bureau of Internal Revenue

PH10 · BIR Zonal Values (And How To Use It Properly)